Whether you tap, transfer, click or swipe, with your phone, watch, card, fingerprint or fingertips, all kinds of personal and business transactions are increasingly electronic across Australia and the world. Cash is fast disappearing.

With fintech startups and traditional financial institutions offering new apps and options daily, proving your identity is essential for securely setting up and using all these payment options.

But this convenience comes with serious risks.

The Australian Bureau of Statistics (ABS) released research in 2024 that revealed ~2.95 million Australians had experienced card fraud, scams, identity theft, or online impersonation in the previous 12-month period*.

One simple yet powerful way to minimise these risks is for providers to implement digital user identity verification during the registration process for electronic transaction services.

Get to know digital identity verification

Personal identity verification is an action a business or government takes to ensure the authenticity and validity of a user's identity.

Verifying a person’s identity requires a combination of gathering, verifying and cross-matching official identity documents, sensitive personal information, passwords, PINs, photos and signatures.

Previously, users needed to prove their identity in person with physical documents. As technological innovation has developed, identity verification can now be done online without the need to meet face-to-face.

Security and protection when transacting online

Integrating digital identity verification into online services – from applications and registration to agreements and transactions – can simplify and secure the user experience of accessing services.

As an extra layer of protection on top of traditional methods of identification, modern digital identity verification processes generally ask for certain biometric data, such as face ID, fingerprints, and iris or retina matching, which verifies that the applicant is a real person, is not wearing a mask, and is not being represented by someone else.

The process also minimises the potential for human error because it is automated using specialised technology. The authenticity of the user's identity is also more secure when equipped with a liveness detection system.

Good for you, good for business

For individuals, advanced trusted digital identity and document authenticity technology means you know who you’re dealing with and can transact with confidence.

Businesses can maintain control, security, and compliance by encrypting and securely storing all sensitive consumer information to meet evolving regulations. Digital identity verification can also speed up new user registration and revenue for online platforms by delivering smooth and fast verification anywhere and at any time, whether in person or not.

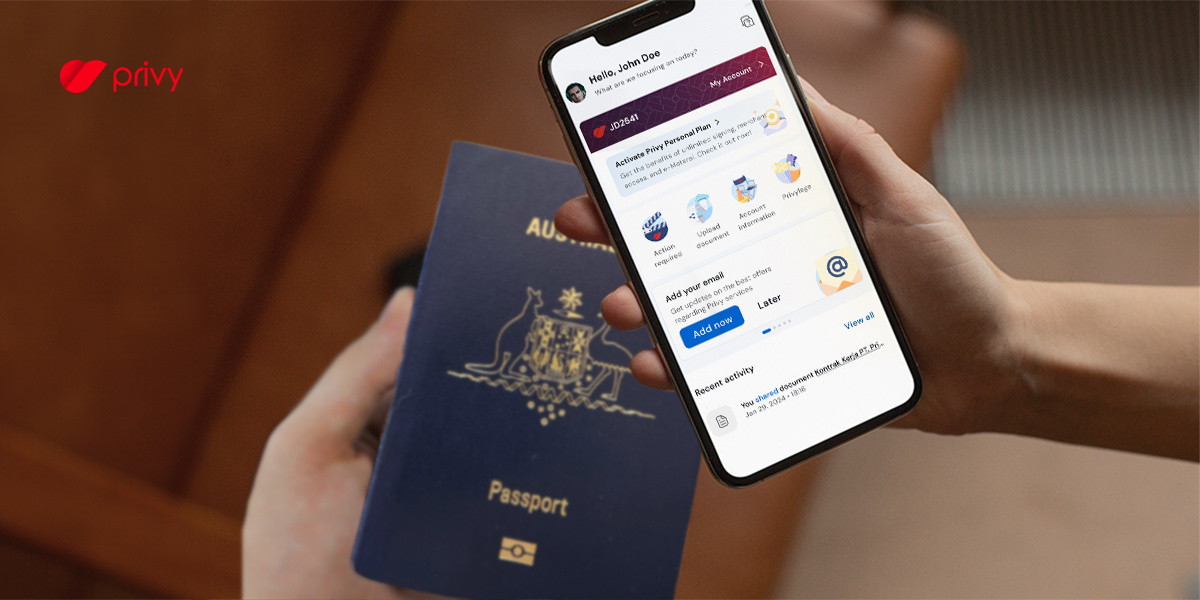

Protect your privacy with Privy’s digital identity verification

With over 45 million onboarded customers, 120 million signed documents and 3,000+ companies under our protection since 2016, Privy is a leading digital trust provider.

Prove Privy yourself with a free personal account or try Business Suite with a 30-day trial. Learn more at privy.com.au #ProveItWithPrivy

* ABS: Personal Fraud Statistics including card fraud, identity theft, and scams, 2024

Similar articles

Are electronic signatures legally binding in Australia for contract execution?

In an era defined by digital transformation, the conventional ink and paper methods of signing...

Read more

The importance of digital signatures in the age of cybercrime

Identity theft, fraud, scams and cyberattacks – now using artificial intelligence and deep fakes –...

Read more